MR_Y

Well-known member

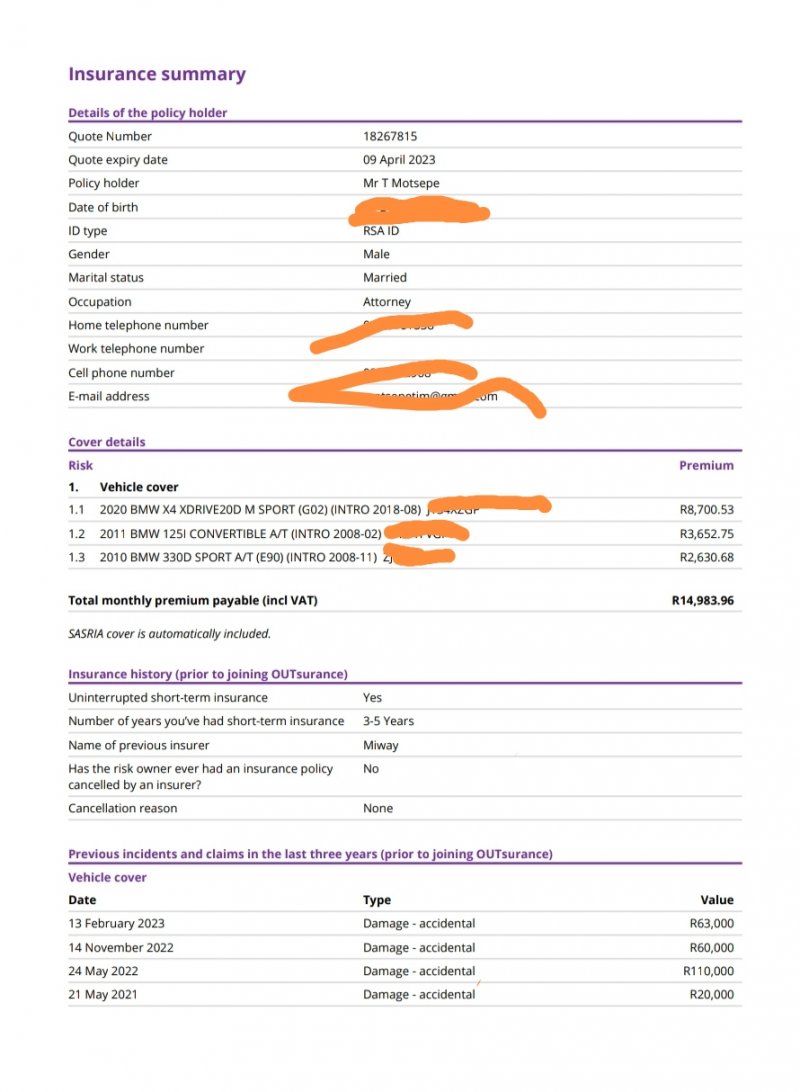

Updates attached.

This is general info available to all clients, so no risk of confidentiality issues by sharing this

Some of the main changes:

- Do not pay your premium with money obtained from any criminal activity

- Trauma counselling included up to a limit

- Won’t cover any loss, damage, liability that is caused by Electricity Grid Failure (this is not the same as normal loadsheding).

- Private repairs to car: If you would like to proceed with a private repairer (that is not included on our panel of approved repairers) you will need to provide us with a quote from your preferred repairer. If we agree, we will settle the claim in cash by paying for the lowest quote between our repairer and your repairer. ● Should you choose to proceed privately, we will not be liable for any consequential loss or damage following the repair to your vehicle.

- Damage caused by vermin or domestic animals: There is no cover for loss or damage caused by domestic animals that belong to you or anyone living at your risk address. We also do not cover loss or damage caused by vermin (except for monkeys and baboons). Vermin are animals and insects that can be harmful and difficult to control when they appear in large numbers. Vermin include moths, termites or any other animal or insect classified as invasive species.

- Cars younger than 12 months: If your car is insured for its retail value, we may choose any of the following methods to settle your claim: ● Replace: We may replace your car with a used car which is similar to or better than your car which was stolen or written-off. If your car is still financed, remember that your financial institution’s interest still takes priority. We will explain the process to you at the claim stage and we will only replace your car if you agree to it

- Remote jamming theft of contents in car: There is CCTV footage showing evidence of remote jamming and the item is out of view, for instance inside a locked boot, inside the glove compartment or under a seat.

- Laundry on the line: There is no longer cover for laundry on the line

This is general info available to all clients, so no risk of confidentiality issues by sharing this

Some of the main changes:

- Do not pay your premium with money obtained from any criminal activity

- Trauma counselling included up to a limit

- Won’t cover any loss, damage, liability that is caused by Electricity Grid Failure (this is not the same as normal loadsheding).

- Private repairs to car: If you would like to proceed with a private repairer (that is not included on our panel of approved repairers) you will need to provide us with a quote from your preferred repairer. If we agree, we will settle the claim in cash by paying for the lowest quote between our repairer and your repairer. ● Should you choose to proceed privately, we will not be liable for any consequential loss or damage following the repair to your vehicle.

- Damage caused by vermin or domestic animals: There is no cover for loss or damage caused by domestic animals that belong to you or anyone living at your risk address. We also do not cover loss or damage caused by vermin (except for monkeys and baboons). Vermin are animals and insects that can be harmful and difficult to control when they appear in large numbers. Vermin include moths, termites or any other animal or insect classified as invasive species.

- Cars younger than 12 months: If your car is insured for its retail value, we may choose any of the following methods to settle your claim: ● Replace: We may replace your car with a used car which is similar to or better than your car which was stolen or written-off. If your car is still financed, remember that your financial institution’s interest still takes priority. We will explain the process to you at the claim stage and we will only replace your car if you agree to it

- Remote jamming theft of contents in car: There is CCTV footage showing evidence of remote jamming and the item is out of view, for instance inside a locked boot, inside the glove compartment or under a seat.

- Laundry on the line: There is no longer cover for laundry on the line

Attachments

Last edited: